The EIN is the taxpayer identification number issued and used by the IRS to identify entities to the IRS. After PBUSA approves the application, PBUSA helps the organization to incorporate and obtain an employer identification number (EIN). PBUSA reviews the application to make sure the organization meets requirements to be a 501(c)(3) organization under PBUSA’s group exemption. To obtain IRS tax-exempt status under PBUSA’s group exemption, a PTO (parent teacher organization) or school booster club completes PBUSA’s online application and submits the joining fee. PBUSA was granted a group ruling by the IRS in 2005. How Parent Booster USA (PBUSA)’s group exemption works The process also frees the IRS from reviewing hundreds, and sometimes thousands, of nearly identical exemption applications of the subordinates of a parent organization. This process allows the subordinate organizations to obtain IRS tax-exempt status without filing an IRS form 1023 or 1024 and paying the IRS fee to apply.

The second way to obtain IRS recognition of tax-exempt status is under an IRS group ruling.įor the “administrative convenience” of the IRS, the IRS created a process by which a “parent organization” may add its “subordinate organizations” to the IRS records. Other types of tax-exempt organizations (business leagues/trade associations, unions, social clubs, social welfare organizations) file Form 1024. Larger charitable organizations file form 1023. Small, charitable organizations with anticipated total income of $50,000 or less may use Form 1023EZ. There are three main forms: 1023EZ, 1023, and 1024. The most common way to obtain IRS recognition of tax-exempt status is to apply to the IRS on the appropriate IRS Form. Two-ways to obtain IRS recognition of tax-exempt status IRS recognition and including the organization in the IRS’ Business Master File (BMF) of exempt organizations is needed to obtain the benefits of tax-exempt status. However, claiming tax-exempt status without also obtaining recognition from the Internal Revenue Service (IRS), does little good. Interestingly, the law provides that any organization that meets the requirements is tax-exempt.

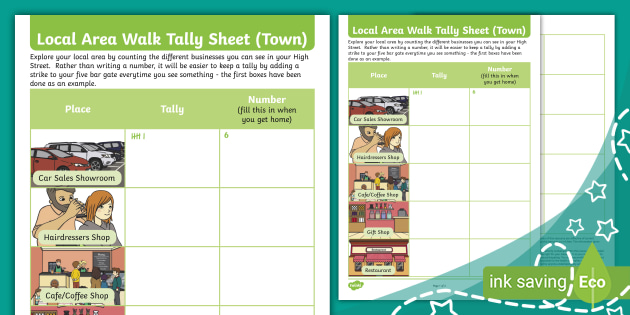

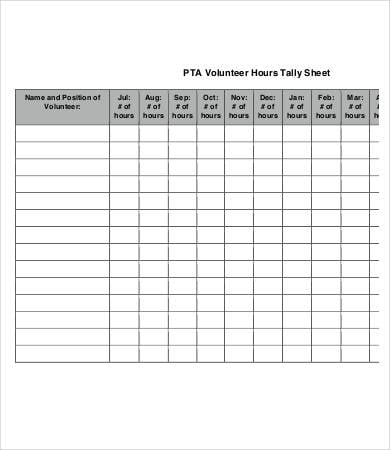

TALLY SHEET CODE

The requirements to qualify for federal tax exemption are set out in the Internal Revenue Code (IRC), primarily in Section 501(c). However, these organizations must still file an IRS tax return (sometimes called an “information return” because no tax is paid) to tell the IRS about the group’s income, expenses, and key activities. This means that these tax-exempt organizations do not have to pay federal income tax on the earnings of the organization. Under the United States federal tax law, organizations that meet specific requirements may claim exemption from paying federal income tax. Group Exemption Fact Sheet, Help for Tax-Exempt Subordinates

0 kommentar(er)

0 kommentar(er)